A few weeks ago we witnessed the announcement of the US government about the possibility of restrictions and obstacles to those US investments made in China directly or indirectly, using or not using the stock market; as well as Chinese investments made in the United States, especially those that are financial in nature, such as government bonds. As we can see, the Trump Administration is sending clear and clear signals to global economic agents that cannot be interpreted without increasing the risk margins that condition the economic activity they carry out.

US investment in China rises despite trade war, says consultancy - Tom Hancock - Financial Times

US investment in China rises despite trade war, says consultancy - Tom Hancock - Financial Times

The North American investment was the fundamental base on which rested the portentous growth of the Asian giant that, together with the low wages and the access of the Chinese products to the North American market, generated an economic dynamics so accelerated, as it has never been seen before. Now, things have been changing, the volume of North American investment has been surpassed by the volume of Chinese investment, so, although it continues to be important, it no longer has the primary character it had a few decades ago. However, it is gross investment volumes that temporarily prevent China from taking the path of economic recession.

We would have said that the characteristics that the Chinese economy has prevents it from having an effective monetary and fiscal policy that would allow it to counteract the effects of a probable economic recession that is yet to come, so we suggested that a fairly heterodox measure, such as subsidy to companies, could contribute, to some extent, to shovel the effects of the referred recession.

However, connoisseurs of the Chinese economy and those who manage to obtain information circulating on the grounds of the Chinese Nomenclature say that such recession will not occur because the Asian giant has the resources to undertake investment projects that maintain the Chinese economy in constant dynamism.

If the Chinese Nomenclature, led by Xi Jinping , decides to allocate surplus sources of the Chinese economy to the execution of investment projects of various kinds, the global economic outlook changes substantially. We would have then that the next decade will show us two nations enjoying a great economic boom, China and the United States. This would happen despite the fact that as of 2023 the US economy began to experience problems with pricing and while, on the other hand, the rest of the world was torn between recession and economic stagnation. However, the scenario is still apocalyptic; by the end of the next decade we could be attending the most spectacular economic contraction event that has ever happened: China could undergo a process of economic contraction that would exceed 20% annually, but, without consequences for the rest of the world; it would be a kind of "disaster of the Tower of Babel".

One of the drawbacks posed by the very rapid growth of the Chinese economy was that it was not accompanied by the strengthening of the institutions of this immense nation, for the simple reason that there was no time for it; there was not even time to count the money generated by the spectacular profits.

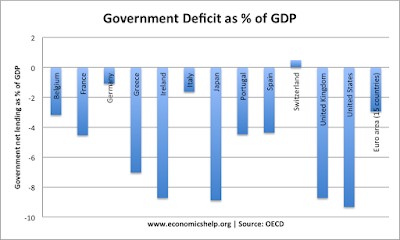

Two of the social benefits that institutional strength brings are credibility and a political system that allows the best possible decision to be taken, given the circumstances. The credibility in the institutions contributes in many ways to the well-being of the citizens who belong to a society that has this characteristic, but, as far as we are concerned, institutional credibility is an indispensable requirement to have a very high Government borrowing capacity. China, despite having excellent economic, social and financial indicators, lacks a government order that has a very high debt capacity as it does, for example, the United States or some European countries. Being able to access a gigantic fiscal deficit is an indispensable requirement for government authorities to perform the necessary maneuvers to avoid economic collapse. China does not have that maneuvering power.

On the other hand, holding power does not guarantee the best decision. A system of political freedoms allows critics to point out, without any fear, what are the points at which some authority is failing; This system may also have mechanisms that oblige said authority to amend the course and correct the mistakes made in the event that it does not wish to do so. Just as the Chinese Nomenclature and the post-Mao reformers brought the Asian giant out of the economic and social disaster in which their country was located, so they can return this nation to its starting point; without anyone being able to do something to prevent it.

The North American investment that begins to be established in China from the decade of the 80 was an investment that generated very accelerated dynamics, an investment destined to the production of tradable goods and services that will be commercialized in other latitudes; it was an investment carried out by the private sector in order to generate large profits, therefore, it was a beneficial investment for society. On the contrary, the investment that China has been developing is fundamentally an investment in infrastructure, which generates a spiral of economic growth more violent than the investment destined to the production of goods and services due to the characteristics of its spending structure; but these do not have a favorable impact on the accounts of the external sector because the service provided by these structures is not transferable. In the same way, the expansive effect that these investments will cause in the internal economy will be merely transitory, since it does not generate the multiplier effects that will prolong this expansion during several economic periods. The operation of the infrastructure does not generate profits if same, but depend on the dynamics caused by other economic sectors. Basing a nation's economic growth on infrastructure investment is dragging that society to collective suicide.

Politicians know that the construction sector generates explosive growth dynamics throughout the economy. In Latin America, for example, political groups that hold power are very concerned about having good interaction with the representatives of the construction sector and providing all the collaboration so that this sector does not find any obstacle in their efforts and projects, but they understand It is also a sector that presents a very unique behavior, so it would be a major mistake to base the economic growth of the nation on the behavior of the construction sector. Such are the characteristics of this sector that Latin American politicians prefer, rightly, to continue with the growth model based on the export of raw materials.

Indeed, the content of what is discussed here is in line with the expectations of investors who handle large money flows globally. This is what indicates the evolution of the yields of Chinese bonds in the very long term since the onset of the trade war. If investors migrate from their long-term Chinese bond positions to other positions, it is because, given the current circumstances, they expect China to be in an unfavorable situation in ten years compared to its current situation. The admirers of the Chinese economy intend to overthrow the previous argument stating that, at this time, the US ten-year bond also shows an unusual rise without economists claiming that an economic catastrophe is expected to occur in the United States.

|

| China Government Bond 10Y |

|

| United States Government Bond 10Y |

At this time some European economies show signs of economic stagnation that cannot be attributed exclusively to the commercial war. This phenomenon, together with Brexit , has caused European economic agents to be extremely cautious when making their consumption and investment decisions but, by themselves, they are not creators of the European stagnation. This extreme prudence may render the monetary incentive plan that the European Central Bank seeks to implement ineffective.

No comments:

Post a Comment