As we said before, there are immense possibilities that the next decade, which begins in less than two months, will be marked, as a fundamental economic trend, by the continued growth of the United States and China while the rest of the world You will find yourself caught in stagnation. This stagnation will generate political and social events that will force governments and the most important economic decision makers to create a new growth model to face such a terrible situation.

Each country or each group of nations will invoke the economic advantages that it possesses to devise, design and execute a growth plan that allows to bury the despair, the bad news and the dreary life that awaits millions and millions of human beings throughout the planet. . Unfortunately, these plans are unlikely to succeed. Only the powerful technological change looks like the factor that allows a nation to obtain high growth rates for a prolonged period of time in order to leave the group of stagnant countries and get into the category of privileged countries, represented by the United States and China

The war of knowledge will not start the next decade. This confrontation began a hundred years ago with the United States and some European nations as protagonists. In the years to come she will worsen because it will be the only viable way out of the secular stagnation, therefore, we will see a significant number of countries struggling to produce technology of high economic impact. At the moment, the United States has a quasi-monopoly situation in technology production, followed by China that has not yet entered the era of high-impact technology production; while other nations venture into the field of low and very low impact technological production.

The American nation has a long way to go in terms of technology production thanks to the incentives offered by a free market economy system and a large amount of military defense. The United States has many decades producing technology of all kinds that are successfully applied in the economy through various business fields. Necessarily and without prior planning, some of these technologies became, almost fortuitously, high-impact technology and generated for several years investment flows that generously remunerated the productive factors involved and indirectly yielded abundant economic benefits even to those who did not they got involved in the activity; This is how the money flows created by the emergence of high-impact technologies stimulate economic growth and provide the resources that will allow governments to combat social problems. The most recent example of high impact technology is reflected in cell phone production. However, just as the rulers and scholars have noticed the effects caused by high impact technologies, entrepreneurs are more cautious in that regard. Indeed, these technologies cause colossal volumes of money that could not be properly channeled by any company and could still jeopardize their existence. As we can see, we can mention what happened with the investment flows that entered the telecommunications sector in the 1990s: no corporation, however gigantic, could monopolize such magnitudes of money and economic activity and the immense proliferation of companies that linked to the sector makes us see the inability of corporations to face the multiplicity of new businesses that result from the emergence of high impact technology. So, it seems, it is the new companies that capitalize on the benefits of the emergence of these technologies, while the corporation that directly linked with the project only takes advantage of a very small fraction of all the immense benefits generated and can even become threatened by a hostile acquisition that a greedy investor wishes to make. Implicit in this phenomenon we see how the luck factor becomes decisive for the appearance, and implementation, of a high-impact technology.

How Technology Affects Economic Growth - Andrea O'Sullivan - The Bridge - Mercatus Center

How Technology Affects Economic Growth - Andrea O'Sullivan - The Bridge - Mercatus Center

A high impact technology is that set of techniques and procedures that will allow the manufacture of a new good, capable of being marketed worldwide, that will have such a huge demand that the company that introduces it to the market will never be able to satisfy . Therefore, to meet this demand, a gigantic number of new companies will also be required to be created to supply the new product. This also implies the rapid creation of a large number of business chains that manage to provide, in the same way, the goods and services related to the main product or that undertakes investments in infrastructure, physical plant, buildings, etc. , that are necessary for That the supply of the main product is a reality. All this without mentioning the colossal volume of marketing tasks that implies taking advantage of the emergence of this high impact technology. As we can see, it is an economic process that, practically, does not harm other economic sectors or create unemployment, but instead stimulates the growth of other productive sectors and is a powerful direct and indirect creator of employment, even for unskilled labor and young people seeking their first job.

The situation of global stagnation will create endless social and political problems that cannot be addressed by the factors that will hold political power. These will be against the wall because they cannot have the capacity to deal with such a number of inconveniences, as they do not have useful tools that will allow them to reactivate the economy and by not having pressure mechanisms to convince the leaders of the USA and China to abandon Your economic isolation policy. Thus, those nations that already have experience in the production of technology will see in the search for high impact technologies the only way to reactivate the economy to get out of the situation of stagnation and mitigate the social and political requirements that beset them .

Obviously, not all technological advances can be considered as high impact technology. Such a characteristic is given by the presence of a colossal demand for the goods produced by this new technology. We can qualify a demand as colossal when, for example, existing companies cannot meet even 1% of the requirements that consumers make to obtain the new good. Hence, it is imperative that a gigantic number of new companies appear to replace the remaining 99% by overcoming the legal and technical obstacles inherent in the use of a technology produced by a third party. On the other hand, a colossal demand does not appear out of nowhere, it needs two fundamental conditions: it must satisfy some need of at least one hundred million human beings and, at the same time, have an affordable price. It is not easy to accurately predict which will be the field in which the new technology appears high impact, but there are some candidates. Climate change will create new needs for several billion people, of which at least one hundred million could be able to pay for such attention. Humans will need to withstand high temperatures, inclement rains and fierce hurricanes and for this some high impact technology may be available.

In a superficial and fast way we could estimate the composition of the global technology production that is being carried out at the moment. We believe that, today, in the era of vertiginous technological change, 99% of all technology production is of low or very low impact, while the remaining 1%, or less, corresponds to medium impact technology. The technology production model that takes place on the planet does not contemplate the emergence of high impact technologies, hence its appearance is a fundamentally fortuitous event. That is why, from the next decade, a select group of countries, beset by major political problems, will begin the path of designing economic policies aimed at increasing the chances of high-impact technologies.

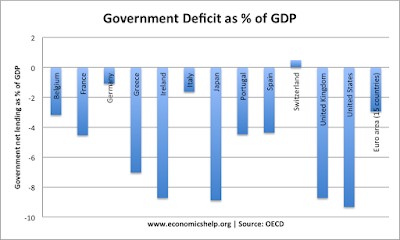

Industrial revolution and high impact technology are not synonymous, the fundamental difference between the two processes is that the former does not exert great influence in the field of the macro-economy and can even deteriorate it, while the latter affects with great power the magnitude of macro-economic variables and national accounts. High-impact technology creates large investment flows that will improve the balance of payments profile, increase the volume of commercial transactions with the rest of the world in order to strengthen the trade balance; These two factors, together, will give a powerful incentive to economic growth and then increase consumption, which will also become another engine of growth; on the other hand, it will eliminate unemployment and substantial wage increases will occur in the range of workers and employees of medium and high qualification; the fiscal deficit can be eradicated without the need for rulers to adopt fiscal measures; interest rates may return to be within reasonable margins to strengthen the health of financial systems; uncertainty would disappear and we would have new times, better times.

Industrial revolutions introduce new products to the market, create powerful companies, change the habits of a large number of people, are a sign of power and ingenuity but, definitely, do not exert a great influence on the macro-economy and do not allow to address social problems , but often creates or increases them. While high impact technology is a fundamentally economic process, industrial revolutions are evidently technological processes that appear through the action of a scientific discovery. Today's industrial revolutions are not driven by scientific discoveries but by the profit motive of corporations and where scientific discovery is one more gear in the technology production chain. The perspectives indicate that the set of phenomena that will overwhelm many during the next decade will force the rulers to put science and technology as a source of wealth, not only for large corporations and for the richest 1% of the planet but also for the less favored, for those who have never had anything. In that sense, high impact technology will help reduce inequality.